CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

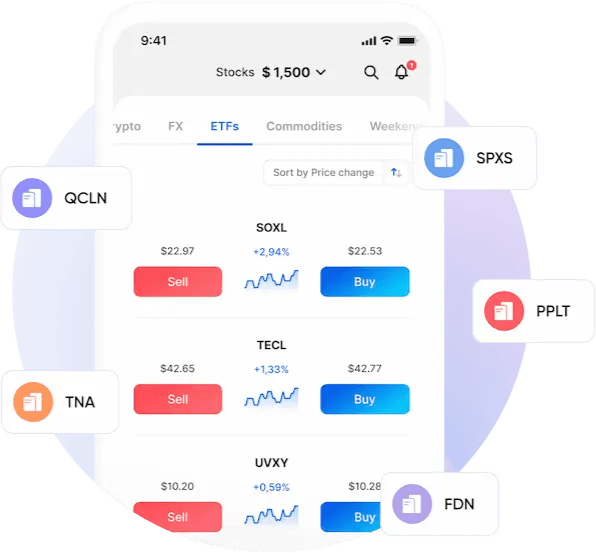

Trade CFD ETFs - Exchange Traded Funds – to gain exposure to a wide range of stock Emirates Global Markets, sectors, commodities, bonds and currencies. Buy the ones you like, short the ones you don’t.

Trade ETFsETF is short for: Exchange Traded Fund.

ETFs combine the features of funds and equities into one instrument. Like other investment funds, they group together various assets, such as stocks or commodities. This helps the ETF track the value of its underlying market as closely as possible.

For instance

There are ETFs that track the FTSE 100, containing constituents of that index proportional to the FTSE’s price. Other exchange traded funds may group together companies working in certain sectors, like Lithium producers, or follow an asset like Gold.

Here are some of the most commonly occurring Exchange Traded Funds available for investors.

These include government bonds, corporate bonds, and US municipal bonds, covering state and local bonds

Used by forex investors to invest in a variety of currencies such as USD, EUR, or GBP

These group together different commodities, with popular funds including oil ETFs, gold, and other metals

Group together stocks in a specific industry, they may take a wider view of their industry, representing companies working across all sectors, like tech manufacturers, component suppliers, technology retailers etc

An inverse Exchange Traded Fund attempts to earn gains from stock declines by shorting stocks, commodities, bonds or other financial assets

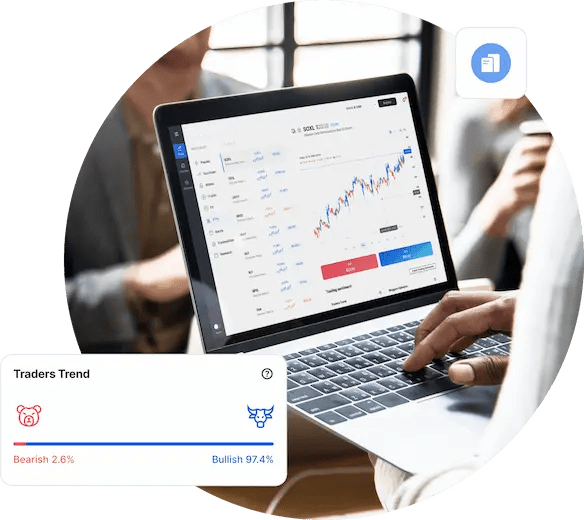

A CFD account will allow you to trade online while accessing a variety of ETFs. Go long or short depending on your view of the market.